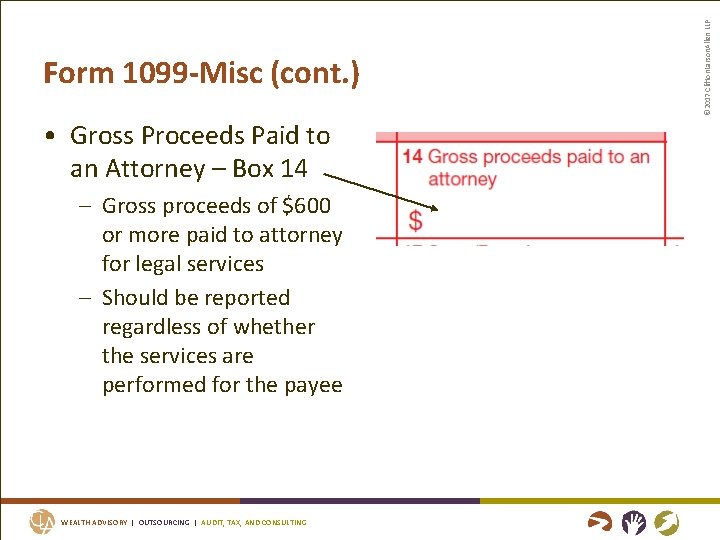

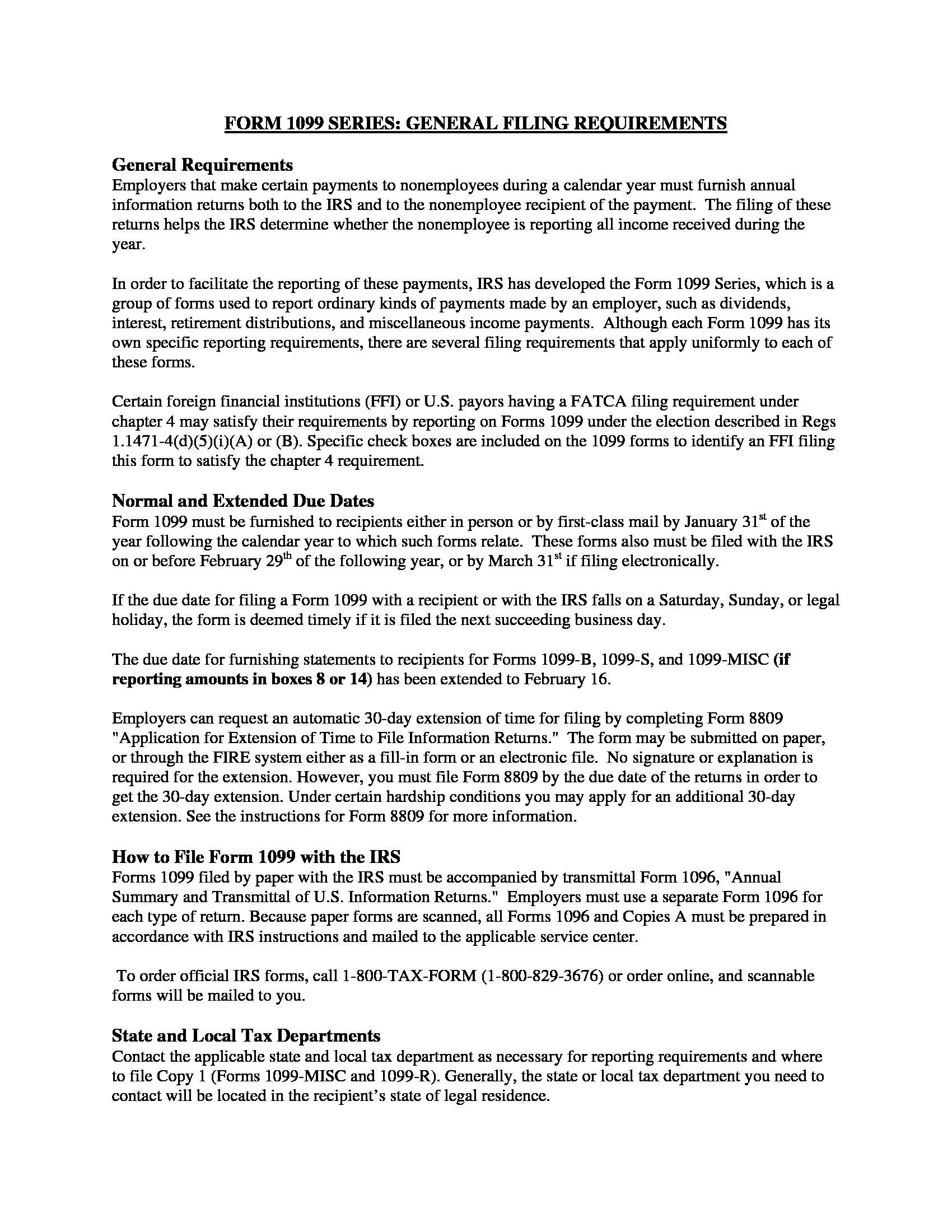

1101 · Your Form 1099 Composite may include the following Internal Revenue Service (IRS) forms 1099DIV, 1099INT, 1099MISC, 1099B, and 1099OID You'll only receive the form(s) that apply to your particular financial situation;Your Form 1099 Composite may include the following Internal Revenue Service (IRS) forms 1099DIV, 1099INT, 1099MISC, 1099B, and 1099OID You'll only receive the form(s) that apply to your particular financial situation and please keep for your records Please note that information in the YearEnd Summary is not provided to the IRSIn this article Applies To Microsoft Dynamics AX 12 R3, Microsoft Dynamics AX 12 R2, Microsoft Dynamics AX 12 Feature Pack, Microsoft Dynamics AX 12 The Tax 1099 summary report is used to print a summarized list of 1099 statement information for vendors The report

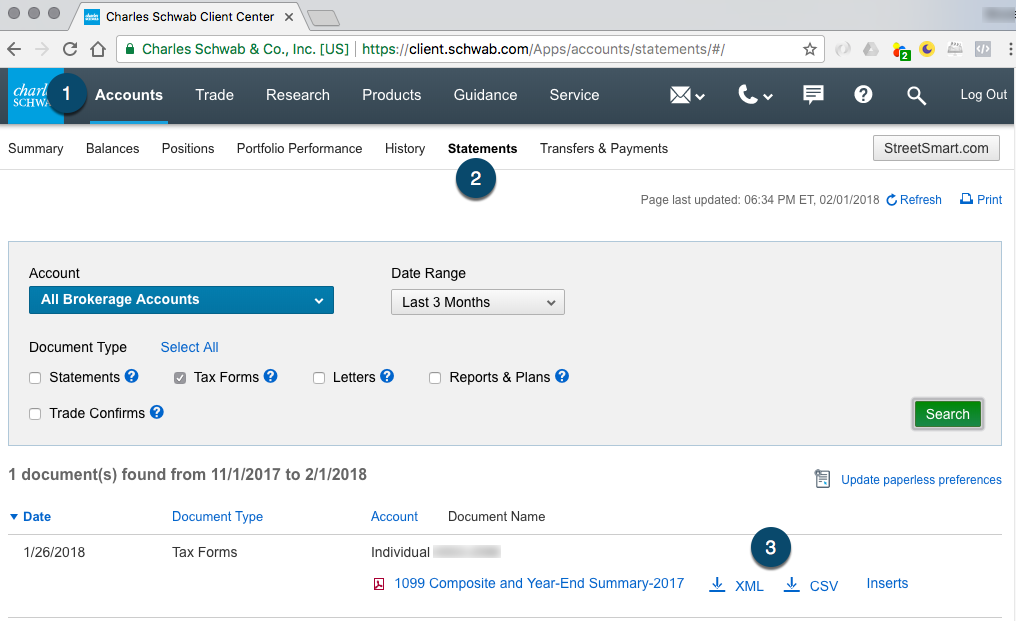

Schwab S Revised Form 1099 Composite Charles Schwab

1099 composite and year-end summary

1099 composite and year-end summary-0411 · Welcome to yearend and all the fun changes for 1099's!Form 1099 Composite Early and midFebruary Form 1099 Composite section in "Tax form reporting" Account Summary Report (ASR) End of February "Introduction to the Account Summary Report and Yearend Realized Gain/Loss Report" Puerto Rico Forms 4806A, 4806B, and 4806D End of February Forms 4806A, 4806B, and 4806D section in "Tax form

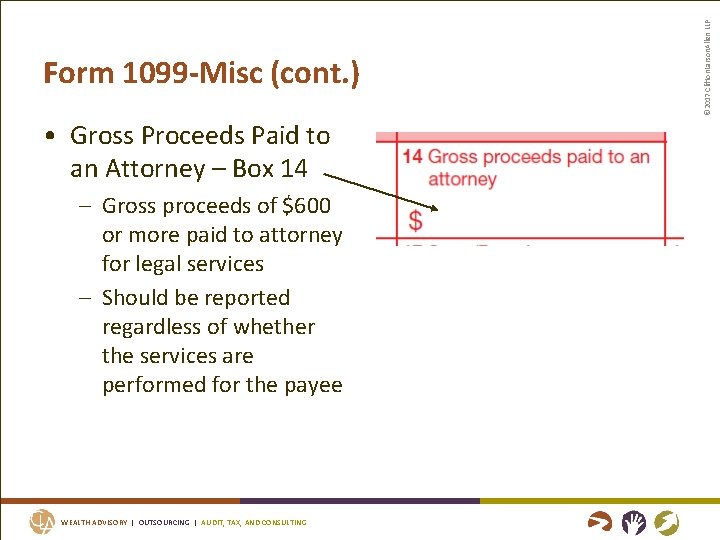

What Are Gross Proceeds On A 1099 B

Your Form 1099 Composite may include the following Internal Revenue Service (IRS) forms 1099dIV, 1099InT, 1099MISC , 1099B and 1099OId You'll only receive the form(s) that apply to your particular financial situation and please keep for your record Please note that information in the YearEnd Summary is not provided to the IRS1701 · Your Form 1099 Composite and YearEnd Summary Report contains the information you need to complete your tax preparation in one easytouse report Depending on your particular situation, your 1099 Composite may include the following forms 1099DIV, 1099INT, 1099MISC, 1099OID, 1099B and YearEnd Summary information Sample 1099 PDFWe've redesigned the Form 1099 Composite, which includes Form 1099B and a YearEnd Summary, to make tax preparation easier Now all tax information is contained in one report—delivered at one time Revised Form 1099B The revised Form 1099B will now provide cost basis information for both covered and uncovered securities

· The time for yearend reporting for wages and other types of payments is drawing near Please review the attached W2 and 1099 categories as the information summarizes the major reporting requirements for compensation related to W2 and 1099MISC issues If one or more categories apply, or if you have any questions or special situations which · A 1099B is the tax form that individuals receive from their brokers listing their gains and losses from transactions made throughout the tax year · These composite forms are sometimes lacking critical information, so you might want to ask a tax professional for help if you receive one Form 1099B Summary TYPE OF INCOME WHAT TO DO WITH IT Sales price of stocks and

In this article If you do business with vendors that are subject to United States (US) 1099 tax, you must track the amount that you pay to each vendor and report that information to the US tax authorities at the end of the calendar yearIf you sell stocks, bonds, derivatives or other securities through a broker, you can expect to receive one or more copies of Form 1099B in January This form is used to report gains or losses from such transactions in the preceding year People who participate in formal bartering networks may get a copy of the form, tooForm 1099 Composite Your Form 1099 Composite is a key tax preparation document that consolidates your Schwabrelated tax information from various forms (Form 1099DIV, Form 1099INT, and Form 1099B) and summarizes relevant account information for the tax year

How To Read Your Brokerage 1099 Tax Form Youtube

Form 1099 Composite And Year End Summary Charles Schwab

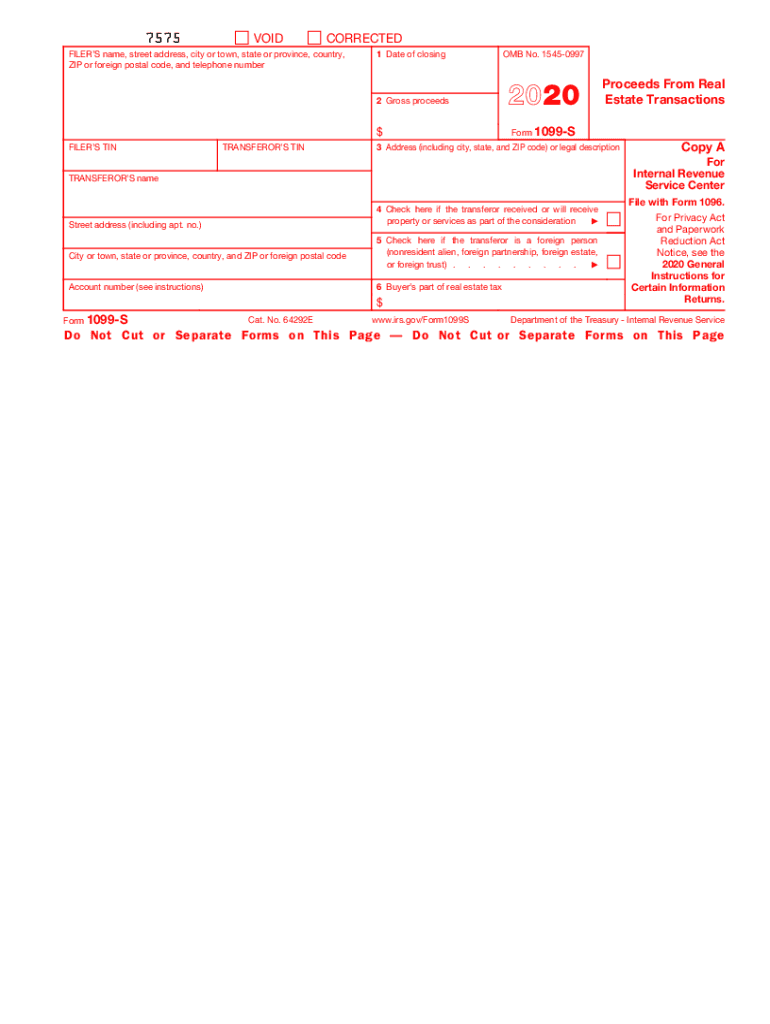

1099B, you may check box 5 and leave boxes 1b, 1e, 1f, 1g, and 2 blank If you check box 5, you may choose to report the information requested in boxes 1b, 1e, 1f, 1g, and 2 and will not be subject to penalties under section 6721 or 6722 for failure to report this information correctly · 1099R and 1099DIV are primarily for documentation (to support your tax filing in the event of audit) Generally, the IRS is also sent a copy of the 1099 directly from the investment company where you hold your investments Therefore, the various types of form 1099 are for the taxpayer's records, in the event of audit in the future · I just received Form 1099 Composite and/or Year End Summary documents, prepared on JANUARY 25, 19, i sold a few very small shares that i bought this year 19 the timing doesn't matter as i had the for a week and decided to sell them for a better stockBut the bulk of my stocks which was bought in Oct 18 i still held on to i only sold one stock which was

17 Tax Guide Form 1099 Oid Original Issue Discount Oid 54 Irs Form 1099 Misc Miscellaneous Income 55 Transactions Pdf Document

What Are Gross Proceeds On A 1099 B

· The Form 1099 Composite has a new layout to allow for additional data fields The date in the YearEnd Summary (formerly Account Summary) is now grouped by Form 1040 schedules The summary includes a table of contents to help you locate information you need New Information on Form 1099B Cost basis Date the security was acquired1302 · The important aspect that we want to focus on for this article on 1099 composite help is the summary information that is usually provided on page 2 This is the meat and potatoes that you need to worry about matching up on your Schedule DComposite 1099 Tax Statement (the Statement _) The Statement is a permitted substitute for official IRS forms and also includes supplemental information Among the forms that may be included on the Composite Statement that HilltopSecurities provides are Form 1099B • Form 1099DIV (except for certain dividends)

Form 1099 Composite And Year End Summary Charles Schwab

Online Generation Of Schedule D And Form 49 For Clients Of Schwab

Please keep them for your records Please note that information in the YearEnd Summary is not provided to the IRSSituations, you must report the income shown on Form 1099 when filing your federal income tax return Please note – Your Consolidated Form 1099 (rather than your December statement) is the official document for tax reporting purposes – Various issuers may provide additional information after yearend;Please keep them for your records Please note that information in the YearEnd Summary is not provided to the IRS

How To Read Your Composite And Year End Charles Schwab

How To Read Your Composite And Year End Charles Schwab

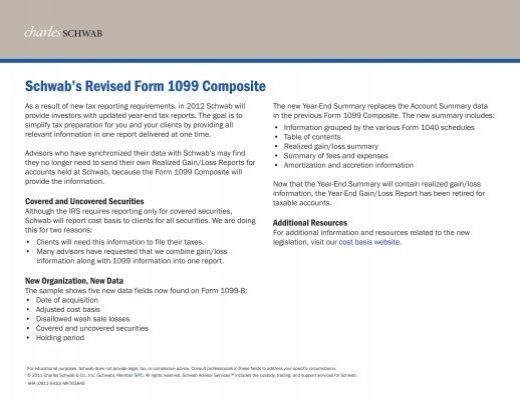

· 1099 – Paper Mailing For retirement accounts, you should have already received your Form 1099R For taxable accounts, 1099 Composite and YearEnd Summaries will be mailed between February 1st and February 28th, depending on the type of investments held inErcise Confirmation Form or YearEnd Exercise Summary Statement • W2, Wage and Tax Statement from your employer • Morgan Stanley Smith Barney's Form 1099B • IRS Form Schedule D Capital Gains and LossesForm 1099 is one of several IRS tax forms (see the variants section) used in the United States to prepare and file an information return to report various types of income other than wages, salaries, and tips (for which Form W2 is used instead) The term information return is used in contrast to the term tax return although the latter term is sometimes used colloquially to describe both kinds

What Is Cash In Lieu On 1099 B

Advisorselect Form W2 1099 15 Year End Services May Be Classified Under Common Law Rules

· I just received Form 1099 Composite and/or Year End Summary documents, prepared on JANUARY 25, 19, i sold a few very small shares that i bought this year 19 the timing doesn't matter as i had the for a week and decided to sell them for a better stockBut the bulk of my stocks which was bought in Oct 18 i still held on to i only sold one stock which wasForm 1099INT is an IRS form that reports all interest payments made during the year and provides a breakdown of the types of interest and related expenses Form 1099INT will only be generated when the aggregate amount of interest income exceeds $108 Performing 1099 YearEnd Reporting This chapter contains the following topics Section 81, "Understanding IRS 1099 Reporting" Section , "Understanding the Write Media Program" Section , "Understanding How to Print 1099s by Company" Section 84, "Printing 1099 Returns" Section 85, "Writing 1099 Data for Electronic Filing"

Tax Information Center Fidelity Institutional

A Comprehensive Guide To Your Composite 1099 Tax Statement Pdf Free Download

Summary Report for Form 4804/4802 You use the Summary Report for Form 4804/4802 to complete Form 1096 (Annual Summary and Transmittal of US Information Returns), which you must file if you do not file 1099s electronically The 1099 software does not generate the 1096 form for you automaticallyComposite Form 1099 3 Combines Forms 1099DIV and 1099B reporting for nonretirement accounts into one form Form 1099DIV Reports total ordinary, qualified, and taxexempt interest dividends, total capital gain distributions, unrecaptured Section 1250 gain, federal income tax withheld, Section 199A dividends, foreign tax paid, return of capital (ROC) and any specified10 minutes to read;

Fillable Online How To Read Your Composite And Year End Charles Schwab Fax Email Print Pdffiller

What Are Gross Proceeds On A 1099 B

Since business doesn't stop and usually businesses leave year end open past the first workday, why doesn't the summary screen track in a similar fashion to 1099 (except maybe use posting date as the basis)?This is your official Form 1099DIV, reported to the IRS It reports totals of reportable dividends and other distributions you receive during the year Forms will be generated only if the aggregate amount of dividends and other distributions you receive exceeds $10 2 1099MISC This is your official 1099MISC, reported to the IRS1099 Informatio uide 1099 Information Guide 2 Your Consolidated Form 1099 is the authoritative document for tax reporting purposes Due to Internal Revenue Service (IRS) regulatory changes that have been phased in since 11, TD Ameritrade is now required (as are all brokerdealers) to report adjusted cost basis, gross proceeds, and the holding

Tax Prep Tips 1099 Tracking Reporting Bogart Wealth

1099 Forms In View 1099div 1099g 1099int 1099m 1099r

Your Form 1099 Composite may include the following Internal Revenue Service (IRS) forms 1099DIV, 1099INT, 1099MISC, 1099B, and 1099OID You'll only receive the form(s) that apply to your particular financial situation; · I have always been curious about the summary screen as they have always been usless for us Why doesn't GP track summary screens better? · This reply was created from merging an existing thread My gross sales do not match my 1099 For example, according to the December 18 Square report, my gross sales were But my 1099 for December states !

17 Tax Guide Form 1099 Oid Original Issue Discount Oid 54 Irs Form 1099 Misc Miscellaneous Income 55 Transactions Pdf Document

Tax Prep Tips 1099 Tracking Reporting Bogart Wealth

2 minutes to read;Annual Visa/Checking Statement, Form 1099R, Form 1099SA and Form 1099Q One link status page is produced per statement mailing (mailings may include more than one account per package) Cover page Your tax reporting statement's cover page includes a Table of Contents that directs you to the start of each major section A stopThis year, the IRS has released a new 1099NEC form that is required for tax reporting for NonEmployee Compensation (NEC) NEC information was previously reported in Box 7 on the 1099MISC form, so a whole new form is required this year

/10167119-F-56a938623df78cf772a4e2f5.jpg)

Report 1099 A And 1099 B Data On Your Tax Return

Advisorselect Form W2 1099 15 Year End Services May Be Classified Under Common Law Rules

19 TAX AND YEAREND STATEMENT As of Mailed by ayer noraton PERSHING LLC Federal dentcaton uer Summary of Form 1099OID Details are reported to the IRS Refer to the 1099OID section of this statement for those details Amount15 TAX AND YEAREND STATEMENT s of Mailed by Payer Information PERSHING LLC Federal Identification Number Summary of Transactions We Do Not Report to the IRS (See instructions for additional information) Amount ShortTerm Transactions Not Reported to the IRS on Form 1099B (Informational Only) · The document should contain three separate tax documents that you need to report A 1099DIVthat gets reported in TurboTax under Interest and Dividends A 1099INTthat also gets reported under Interests and Dividends A 1099B

Schwab S Revised Form 1099 Composite Charles Schwab

Are Investment Management Fees A Tax Deduction Simplifi

Form 1099B is issued on Schwab's 1099 Composite Year End Summary report which consolidates all types of Form 1099 reportable activity Schwab typically provides the 1099 Composite Year End Summary each year between lateForm 1099DIV on the summary page, these amounts are reported to the IRS in aggregate The transaction details are provided on the Details for Dividends and Distributions for your reference • Reinvested dividends are reported on the 1099DIV as ifThe Form 1099 Composite has a new layout to allow for additional data fields The data in the YearEnd Summary (formerly Account Summary) is now grouped by Form 1040 schedules The summary includes a table of contents to help you locate information you need

16 Tax Form Availability Dates Apriem

How To Read Your 1099 Robinhood

I just can not figure out these seemingly random sales numbersThis video shows you how to make a contractor/vendor eligible for 1099, run the proper end of year report as well as process year end tax forms such as the 1Form 1099DIV is used to report dividends and capital gain distributions declared in by Fidelity mutual funds in a nonretirement account Income information on shareholders' periodic account statements may differ from information on the Form 1099DIV due to a reclassification of dividends and capital gains that can occur at yearend or later

A Comprehensive Guide To Your Composite 1099 Tax Statement Pdf Free Download

Video Tutorial Accessing Your Tax Documents On Vimeo

· Yearend 1099 reporting 10/31/17; · (USA) Tax 1099 summary report (Tax1099Summary) ;Both Forms 1098 and 1099A, complete one Form 1096 to transmit your Forms 1098 and another Form 1096 to transmit your Forms 1099A You need not submit original and corrected returns separately Do not send a form (1099, 5498, etc) containing summary (subtotal) information with Form 1096 Summary information for the group of

Preparing For 1099 Changes At Year End Controllers Council

Tax Document How To For Clients Fintrust Capital Advisors

UNDERSTANDING YOUR FORM 1099 CONSOLIDATED TAX STATEMENT INVESTOR EDUCATION TAX PLANNING Reporting investment income and related expenses on your tax forms is simpler with a bit of guidance 1099 Nonreportable Summaries, and 1099R · The document should contain three separate tax documents that you need to report A 1099DIVthat gets reported in TurboTax under Interest and Dividends A 1099INTthat also gets reported under Interests and Dividends A 1099BYearend brokerage statement The Composite 1099 Form reflects current information and shows adjustments such as income reallocations that are made after yearend when announced by issuers Only the Composite 1099 Form should be used for official tax preparation purposes

What Is Form 1099 B Proceeds From Broker Transactions Turbotax Tax Tips Videos

Advisorselect Form W2 1099 15 Year End Services May Be Classified Under Common Law Rules

Therefore, amounts shown on your · Most churches and organizations file Form 1099 as a part of yearend procedures Any vendor with invoices marked as 1099 and paid in the selected tax year receives a 1099 If the vendor is marked as a 1099 vendor during setup , all invoices for that vendor are marked as 1099 purchases unless you clear the 1099 option when entering invoices

Schwab S Revised Form 1099 Composite Charles Schwab

Year End 1099 Misc Irs Copy Forms

:max_bytes(150000):strip_icc()/1099misc-640a2c257de14027971a0751a2d8bd29.jpg)

Form 1099 Definition

Reit Tax Advantages Demystifying Your 1099 Div Jamestown Invest

0 件のコメント:

コメントを投稿